平野 剛志(宅建士・リフォームスタイリスト)

We feel more than happy to support you!

CLOSE

公開日:2024年3月16日

Hi, I am Takeshi Hirano, the REDS agent. Are you having a hard time in financing to purchase a property in Japan? Well, here is the key! We might be able to support you on that issue. Even a foreign national without PR (Permanent Residency) has a chance to obtain a housing loan from a bank. Today, we are going to elaborate more on that!

If a foreign national wishes to utilize a housing loan in Japan, generally, it is necessary to have permanent residency (or the spouse to be a Japanese national). However, some banks may consider providing housing loans to individuals with a certain level of residential stability in Japan, meeting specific annual income requirements and length of employment, even without permanent residency. The available options depend on the individual’s circumstances.

Once you have identified the property you wish to purchase, the next step after obtaining a housing loan is the pre-screening process. Typically, the evaluation of a housing loan by financial institutions occurs in two stages: preliminary screening (pre-screening) and main screening.

Both stages involve an assessment of the property to be purchased and the borrower, but the pre-screening is usually more simplified. The documents required for pre-screening include personal identification documents such as a driver’s license, income-related documents such as withholding tax statements, as well as property brochures or flyers. From the stage of applying for pre-screening, a REDS agent will assist you, so you can rest assured.

The typical duration for pre-screening is usually around one week. However, in some cases, results can be obtained within 2 to 3 days. During this process, you can gain a rough estimate of the interest rate and the amount you can borrow.

During the main-screening, both the borrower and the property undergo a more detailed evaluation, necessitating a greater number of documents. In addition to personal identification documents such as a driver’s license, documents like a resident certificate and a certificate of seal impression (inkan shomeisho) are also required for personal identification. These documents are typically issued at local government offices, but please be aware of any time restrictions, such as issuance within three months.

For income-related documents, you’ll need documents such as the local tax assessment notice and a tax certificate. Additionally, if you’re a corporate representative, submission of corporate financial statements may also be required. Regarding property confirmation documents, copies of the sales contract, construction contract, and a registration certificate for land and buildings are necessary.

The typical duration for the main-screening is usually around 10 days to 2 weeks. In some cases, it may take a little longer.

Once the main-screening is successfully passed, you will proceed to enter into a housing loan contract (a loan agreement for money lending) with the financial institution. At this point, details such as the interest type and repayment period of the housing loan will be determined. While it is common for the interest rate to be applied based on the execution of the loan, some financial institutions may decide the rate at the time of the housing loan contract.

Housing loan contracts are typically conducted at the counter of the financial institution on weekdays, so you may need to take time off from work to complete the procedures. There are usually no additional documents required to be submitted at the time of contract signing, but a personal seal (inkan) or officially registered seal (Jitsuin) to the financial institution may be necessary.

Once the housing loan contract is completed, all that remains is for the loan to be executed, and the borrowed funds to be transferred to the designated account (seller’s account). However, the execution of the housing loan typically occurs simultaneously with the handover of the property. This is known as “simultaneous settlement.” The execution of the housing loan and the handover of the property are commonly conducted at the financial institution on weekdays. Since procedures are conducted on weekdays, it may be necessary to take a day off from work on that day.

On the day of the execution of the housing loan and the handover of the property, ownership registration procedures are also conducted. This involves registering the ownership rights of the purchaser for the land and building, as well as registering the mortgage rights of the financial institution. Registration takes place at the registry office (legal affairs bureau), but typically, a judicial scrivener (Shiho-shoshi) designated by the financial institution will handle the actual procedures, and the purchaser will only need to sign and affix their seal on the necessary documents.

This roughly outlines the process from applying for a housing loan to its execution. If you’re using a housing loan for the first time, you may have questions or concerns. In such cases, please don’t hesitate to consult with a REDS agent. We’re here to provide full support to ensure your real estate transactions with a housing loan proceed smoothly.

【REDS】Real Estate Distribution System (REDS) Japan

Takeshi Hirano (Mr.)

mailto: ta.hirano@red-sys.jp

公開日:2024年2月4日

Hi, I am Takeshi Hirano, the REDS agent.

If you’re looking for the lively heart of Tokyo’s city life, Shibuya is the place to go. This bustling neighborhood is full of youthful energy and has something for everyone, whether you’re a local or a tourist.

Starting as a simple residential area, Shibuya has grown into a busy center of culture and business. It’s changed along with Tokyo itself, going from recovering after the war to being known worldwide. Today, Shibuya sets trends in fashion, technology, and entertainment.

(The statue of loyal dog “Hachiko”)

Shibuya Crossing shows how busy Tokyo can be and captures the energy of the area. The nearby Hachiko Statue is famous for its story about loyalty and attracts visitors from all over the world.

(The Shibuya Crossing)

In Shibuya, you’ll find lots of shops, from big department stores to small specialty shops. Whether you’re into high-end fashion or streetwear, Shibuya has something for you and influences trends around the world.

(Shibuya’s new land mark “Shibuya Sakura Stage”)

Shibuya’s food scene is a dynamic fusion of traditional Japanese flavors and international cuisine. From cozy izakayas serving fresh sushi and sizzling yakitori to chic cafes offering specialty coffees and decadent desserts, Shibuya caters to diverse tastes. With its bustling food markets, trendy eateries, and innovative fusion restaurants, Shibuya is a culinary hotspot that promises an unforgettable gastronomic adventure for food lovers from around the world.

Shibuya’s nightlife is legendary, pulsing with energy and diversity. From chic cocktail lounges to bustling karaoke bars and electrifying clubs, there’s something for everyone. The iconic Shibuya Crossing transforms into a neon-lit spectacle, while izakayas and street-side stalls offer authentic experiences. Whether you’re into live music, dancing, or simply people-watching, Shibuya’s nightlife promises unforgettable moments in Tokyo’s vibrant heart.

Shibuya is a cultural and artistic hub, blending modernity with tradition. Its streets showcase contemporary art, trendy galleries, and innovative performances. From street murals to interactive installations, Shibuya’s dynamic cultural scene reflects Tokyo’s creative spirit. The district’s fusion of fashion, design, and cutting-edge technology makes it a captivating destination for those seeking a glimpse into Japan’s evolving cultural landscape.

Shibuya is easy to get to and get around thanks to its great transportation system. Shibuya Station connects you to everywhere in Tokyo and beyond, whether you’re traveling by train, bus, or on foot.

Shibuya is a hub of creativity, diversity, and new ideas in Tokyo. From fashion to food, art to nightlife, there’s always something new to discover. Feel the energy, enjoy the city vibe, and see what adventures await you in Shibuya.

If you would like to find properties in Shibuya area, please feel free to contact us to the following e-mail address at any time.

【REDS】Real Estate Distribution System (REDS) Japan

Takeshi Hirano (Mr.)

mailto: ta.hirano@red-sys.jp

公開日:2024年1月6日

Hi, I am Takeshi Hirano, the REDS agent.

If you want to enjoy the dazzling nights of Tokyo, Roppongi is the perfect place to be. This area is a central hub of international ambiance, boasting high-rise buildings, shopping, restaurants, and nightlife all in one. Let’s embark on a night adventure in Roppongi, an enticing destination for foreign visitors to Japan.

(The Mori Tower in Roppongi Hills)

Originally farmland, Roppongi transformed from post-war reconstruction to become a symbol of Tokyo’s international allure. Today, with a mix of diverse cultures and avant-garde architecture, Roppongi stands as one of Tokyo’s iconic areas. Landmarks like Tokyo Tower and Tokyo Midtown are worth a visit, reflecting the historical and cultural richness of the district.

(The Mohri Garden)

Roppongi Hills and Tokyo Midtown offer a wide range of shopping areas, from luxury brands to unique select shops. Whether checking out the latest fashion trends or discovering Japan’s distinctive crafts and art, Roppongi is ideal for souvenir hunting.

Roppongi is a haven for food enthusiasts. With a variety of world cuisines, from high-end restaurants to casual izakayas, there are diverse culinary options to explore. The restaurants within Roppongi Hills, in particular, showcase the creativity of chefs. Embark on a culinary journey featuring sushi, Japanese cuisine, Italian, French, and more.

The nights in Roppongi unfold with exciting and sophisticated nightlife. Numerous clubs and bars offer performances by international DJs, providing a vibrant and lively atmosphere. Roppongi’s nights are filled with the glow of illuminated buildings, panoramic views, and the pulsating energy of the city.

The museums and galleries within the Roppongi Art Triangle are a paradise for art enthusiasts. Exhibitions and events featuring artists from around the world allow visitors to immerse themselves in the allure of art. Additionally, the cinemas in Roppongi Hills showcase the latest films and Japanese cinema for a diverse entertainment experience.

(The National Art Center, Tokyo)

Access to Roppongi is extremely convenient. It is reachable from the city center by subway or taxi, and there are many hotels in the vicinity. You can return safely even after a night out.

Tokyo Metro Hibiya Line: Roppongi Station

Tokyo Metro Namboku Line: Azabu-Juban Station, Roppongi-itchome Station

Tokyo Metro Chiyoda Line: Nogizaka Station

Toei Subway Oedo Line: Roppongi Station, Azabu-Juban Station

Roppongi, with its refined atmosphere, is particularly appealing to foreign visitors exploring Tokyo. Blend of history and modernity, a variety of entertainment options, and a vibrant atmosphere make Roppongi a must-visit destination. Explore the captivating shopping, gastronomy, nightlife, art, and more – all concentrated in this area. Immerse yourself in the Tokyo night in Roppongi, and you’ll surely have an unforgettable experience.

Are you attracted by Roppongi City now? YES! YOU ARE!!

If you would like to find properties in Roppongi area, please feel free to contact us to the following e-mail address at any time.

【REDS】Real Estate Distribution System (REDS) Japan

Takeshi Hirano (Mr.)

mailto: ta.hirano@red-sys.jp

最終更新日:2024年1月4日

公開日:2023年12月23日

Hi, I am Takeshi Hirano, the REDS agent. Are you aware of the monthly cost associated with owning a condominium, such as the repair reserve fund? Today, I’ll provide an explanation about it!

What is “Repair Reserve Fund” at condos?

The repair reserve fund, also known as the reserve fund, is a savings fund set aside for future major repairs and renovations of the building. This fund is essential for addressing long-term maintenance needs and preventing special assessments for large-scale repairs. Examples of expenses covered by the repair reserve fund include:

Roof Replacement: Major repairs or replacement of the building’s roof.

Exterior Painting: Painting or repairs to the exterior of the building.

Elevator Replacement: Costs associated with the repair or replacement of elevators.

Structural Repairs: Addressing any significant structural issues that may arise.

Residents contribute to the repair reserve fund regularly, and the amount is determined by the homeowners’ association or management company. This fund ensures that there are sufficient funds available when major repairs or renovations become necessary.

In summary, management fees cover the ongoing operational costs of the building, while the repair reserve fund is set aside for future significant repairs and renovations to maintain the long-term integrity of the property.

What is the average amount of this “Repair Reserve Fund”?

The amount of the repair reserve fund varies depending on the building and the region, but generally, it is calculated based on the condition and age of the building, as well as the anticipated future repair needs. Specific amounts are set by the homeowners’ association or management company and are typically distributed evenly among the residents.

Here are some common considerations when determining the amount of the repair reserve fund:

Age and Condition of the Building: Older or deteriorating buildings may require higher fund amounts due to anticipated future repairs.

Future Repair Plans: If there are future repair or renovation plans for the building, funds are set aside based on those projections. For example, this could include the replacement of a new roof or elevators.

Regional Standards: The standard amount for repair reserve funds can vary by region. Some areas may commonly have higher amounts, while others may require relatively lower contributions.

Size and Facilities of the Building: Larger buildings or those with luxurious facilities may have higher repair reserve fund requirements.

As a general guideline, it is common for the repair reserve fund to represent 1-3% of the total income of the building. However, this is a rough estimate, and the specific amount is determined by the homeowners’ association or management company on a case-by-case basis, taking into account the needs of the building and reaching an agreement with the residents.

Are there any guidelines set by the government?

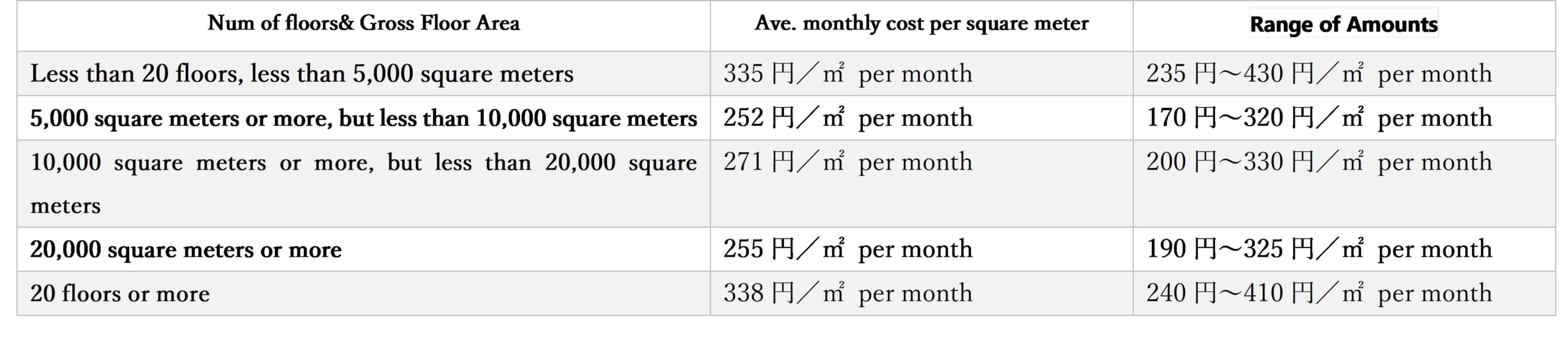

The Ministry of Land, Infrastructure, Transport and Tourism released guidelines in September 2021 regarding the repair reserve fund for condominiums. These guidelines provide a reference for prospective buyers, condominium owners, and management associations to assess the appropriate level of the repair reserve fund. The guidelines include an indication of the recommended amount for the repair reserve fund, serving as a reference point for those making decisions.

The average guideline for the repair reserve fund amount (excluding mechanical parking)

Mechanical parking lots have intricate structures that require regular maintenance and inspections. This involves the upkeep of specialized mechanical components and elevator systems, leading to higher maintenance costs compared to conventional parking lots. As a result, the repair reserve fund may be set higher than usual. When purchasing a property with a mechanical parking system, it is important to be cautious, as there is a potential for incurring costs even if you do not own a car.

Mechanical parking lots have intricate structures that require regular maintenance and inspections. This involves the upkeep of specialized mechanical components and elevator systems, leading to higher maintenance costs compared to conventional parking lots. As a result, the repair reserve fund may be set higher than usual. When purchasing a property with a mechanical parking system, it is important to be cautious, as there is a potential for incurring costs even if you do not own a car.

If you have any further questions or requests, please feel free to contact us to the following e-mail address.

【REDS】Real Estate Distribution System (REDS) Japan

Takeshi Hirano (Mr.)

mailto: ta.hirano@red-sys.jp

公開日:2023年12月11日

When considering the purchase of a used condominium, are there any factors need to be taken into account?

The REDS agent will explain it from the following three perspectives as to aging condominiums.

Potential Issues in Aging Condominiums:

Aging condominiums are prone to several common problems. The first and foremost is the aging of the basic structure and facilities of the building. Over time, plumbing, electrical systems, elevators, and other components are susceptible to deterioration, leading to associated troubles. Water leaks, plumbing blockages, and electrical system malfunctions can impact the living environment and may become challenging to repair.

Additionally, the deterioration of exterior walls and roofs is a significant concern. As this progresses, issues such as water leakage and reduced insulation may arise, necessitating urgent repairs. If these problems remain unaddressed, they could disrupt the lives of the residents.

On the other hand, inadequate seismic resistance is also a concern with aging condominiums. If there is insufficient resilience to natural disasters such as earthquakes, the safety of residents may be at risk.

Challenges in Rebuilding Aging Condominiums:

Rebuilding aging condominiums involves various challenges for several reasons. Firstly, unanimous agreement from all residents is required for reconstruction. In many cases, condominiums are jointly owned properties, and all residents must agree to the reconstruction plan. If some residents do not agree, the reconstruction project becomes more difficult to proceed with.

Additionally, reconstruction involves substantial costs. In the case of aging condominiums, everything from the foundation to the exterior walls and facilities needs to be updated, requiring significant funds. While the burden needs to be shared among all residents, financial issues or the economic conditions of residents can make this challenging.

Furthermore, local regulations and laws complicate the reconstruction process. Urban planning, building codes, and community requirements can pose obstacles to reconstruction, and overcoming these hurdles is not always straightforward.

Ways to Address Issues in Aging Condominiums:

Resolving issues in aging condominiums requires careful consideration and planning. Firstly, a thorough inspection of the building before occupancy is crucial to assess the extent of aging and identify areas in need of repair. Seeking building diagnostics and assessments from professionals and obtaining estimates for future repairs can help understand the costs before purchasing.

Additionally, participating in the management association and resident discussions to advance overall renovation and maintenance plans for the entire building is beneficial. Cooperation among residents enables addressing issues in aging condominiums. Implementing regular maintenance and renovations can prevent future troubles and contribute to improving the living environment.

Ultimately, collaboration with the local community is essential. If the entire community cooperates, aging condominiums can be renovated, maintaining and enhancing an attractive living environment. With community unity and cooperation, the purchase of a used condominium can become more appealing.

If you have any further questions or requests, please feel free to contact to the following e-mail address.

【REDS】Real Estate Distribution System (REDS) Japan

Takeshi Hirano (Mr.)

mailto: ta.hirano@red-sys.jp

公開日:2023年11月11日

Are there any good ways to identify we-maintained condominiums when purchasing?

Yes! We will explain things you have to look at carefully to identify well-managed condominiums.

Exterior and Cleanliness:

Well-managed condominiums have a clean exterior with meticulous maintenance. Check for minimal dirt or damage on the exterior walls and common areas.

Signage and Communication:

In well-managed properties, there are clear signs at the entrance and elevators. Also, check if there is a management office where staff interacts with residents.

Security Measures:

High-quality condominiums often have security measures such as surveillance cameras and keycard access at the entrance, making it less accessible to unauthorized individuals.

Cleaning and Waste Disposal:

Regular cleaning of common areas and well-organized garbage disposal areas are indicators of good management. Compliance with proper waste separation rules is crucial.

Facility Maintenance:

Verify if shared facilities within the condominium (elevators, common toilets, etc.) undergo frequent maintenance. Visible maintenance schedules enhance reliability.

Transparency of the Management Association:

Confirm the transparency of information from the management association. Ideal situations include shared meeting minutes and financial reports with residents’ input on significant decisions.

Adequacy of Repair Reserve Funds:

Well-managed condominiums often have sufficient repair reserve funds. Ensure that there is ample funding set aside for future maintenance needs.

Community Events:

In properties with attentive management, regular community events for residents may be organized. These events foster community engagement and contribute to a positive living environment.

Emergency Response and Support:

A well-managed property is equipped to respond promptly and effectively to faults or emergencies. Ensure that emergency contact information is clearly provided.

Review of Reviews and Reputation:

Checking online reviews and local sources can provide insights into the reputation of the condominium. The authentic experiences of residents serve as reliable indicators.

By carefully examining these points, you can effectively identify well-managed condominiums.

We REDS agents are here to help you looking for good properties in Japan!

最終更新日:2023年9月14日

公開日:2023年9月11日

1. Budget and Financing

Determine your budget for buying a condo in Tokyo, taking into account not only the purchase price but also associated costs like property taxes, maintenance fees, loan interest and legal registration.

Explore financing options, including mortgages available for foreign buyers, and understand the terms and interest rates.

2. Location and Neighborhood

Research different neighborhoods in Tokyo to find the one that suits your lifestyle, commute, and preferences. Consider factors like proximity to schools, public transportation, shopping, and recreational areas.

3. Property Type

Decide on the type of property you want, such as a condo, apartment, or house. Consider your future needs and whether the property allows for potential modifications.

4. Legal Requirements

Understand the legal requirements for foreign buyers in Japan, including visa status and registration procedures. Consult with a legal expert or real estate agent to navigate the complexities of Japanese real estate law.

5. Real Estate Agents

Work with a reputable real estate agent who specializes in assisting foreign buyers and has a good understanding of the local market. Your agent can help you find suitable properties, negotiate deals, and guide you through the process. Yes, we REDS Team is here to support you!

6. Property Viewing and Inspection

Conduct a property viewing o-site and check for any structural issues, water damage, or necessary repairs. Ensure the property meets your standards and expectations.

7. Contract and Documentation

Review all contracts and documents carefully, including the sales contract, property registration, and any HOA agreements. Ensure you understand the terms and obligations before signing.

8. Financing Approval

Secure financing approval from your chosen lender before finalizing the purchase. Keep in mind that financing conditions may vary for foreign buyers.

9. Taxes and Fees

Be aware of property taxes (fixed asset tax), stamp duties, and registration fees associated with the purchase. Budget for these additional costs, as they can be significant.

10. Resale Value and Future Plans

– Consider the property’s potential for resale and investment value.

– Think about your long-term plans in Tokyo and whether the property aligns with your future goals.

It’s crucial to consult with professionals, including a real estate agent and legal advisor, to navigate the intricacies of buying a condo in Tokyo as a foreigner. Additionally, conducting thorough research and due diligence will help you make an informed decision and ensure a smooth purchasing process.

To make all those things clear to you, please contact us, REDS, at any time!

公開日:2023年7月29日

As the COVID-19 pandemic gradually recedes, Japan is experiencing a resurgence in the number of foreign travelers visiting the country. This revival in international tourism is expected to have a significant impact on the demand for Japanese real estate by foreign investors. As a real estate agent catering to the needs of foreign clients, it is crucial to analyze and anticipate the future trends in this market segment to better serve potential buyers. We would like to share a comprehensive outlook on the projected demand for Japanese real estate by foreign investors in the post-pandemic era.

With the easing of travel restrictions and improved confidence in international travel, Japan is likely to witness a surge in foreign visitors. The demand for short-term rental properties, such as vacation homes and serviced apartments, is expected to rise in popular tourist destinations like Tokyo, Kyoto, Osaka, and Hokkaido. Foreign investors may see these regions as lucrative opportunities to invest in properties that can cater to both the domestic and international tourism markets.

The pandemic has accelerated the adoption of remote work and flexible work arrangements globally. As companies embrace remote work policies, some foreign investors may consider purchasing properties in Japan for personal use, as a second home, or as an investment opportunity. Properties in regional cities or rural areas with attractive amenities and a slower pace of life may appeal to those seeking an escape from the bustling city life or as a serene remote working location.

Compared to other major international cities, certain areas in Japan offer relatively affordable real estate options, making it an attractive investment proposition for foreign buyers. Japanese property prices have shown stability and resilience over the years, and with the country’s improving economic outlook, investors may see potential for capital appreciation over the long term.

Recognizing the importance of foreign investment in the real estate sector, the Japanese government may introduce or enhance policies to attract foreign buyers. Streamlined processes for property ownership, eased visa regulations, and tax incentives could further encourage foreign investment, making Japan an appealing destination for international real estate investors.

Japan’s aging population and declining birth rates have been significant factors affecting the real estate market. However, an influx of foreign buyers could mitigate some of these challenges by contributing to a more diverse and dynamic property market. For instance, foreign investors might show interest in properties suitable for co-living or co-working spaces, catering to the needs of younger professionals or students.

An increasing number of foreign investors prioritize sustainability and eco-friendliness when considering real estate investments. Demand for environmentally conscious properties, such as energy-efficient buildings and those with green certifications, is expected to rise among foreign buyers. Japanese developers and agents can capitalize on this trend by promoting eco-friendly properties to appeal to this growing segment.

While the demand for Japanese real estate by foreign investors is poised to grow, there are challenges to address. Language barriers, cultural differences, and varying legal and tax systems can be obstacles for foreign buyers. As a real estate agent, offering multilingual support and guidance through these complexities will be crucial in building trust and facilitating smooth transactions.

The post-pandemic era presents an optimistic outlook for the Japanese real estate market, with the resurgence of foreign tourists contributing to the demand for properties by foreign investors. As an agent, understanding these future trends and anticipating the evolving needs of foreign buyers will be vital in successfully navigating and capitalizing on this growing market segment. By offering personalized services and catering to the preferences of international investors, we believe that our company, REDS can flourish in the years to come.